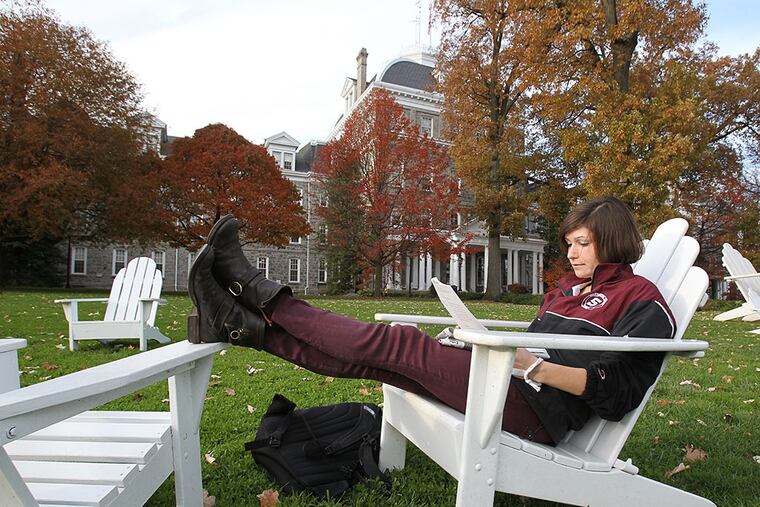

Richly Endowed

Swarthmore College ranks among the nation's wealthiest liberal-arts colleges, overseeing a $1.9 billion endowment - an average of more than $1 million for each of its 1,577 students.

Swarthmore College ranks among the nation's wealthiest liberal-arts colleges, overseeing a $1.9 billion endowment - an average of more than $1 million for each of its 1,577 students.

Swarthmore's endowment prospered in its most recent fiscal year, with publicly traded stocks constituting almost half its portfolio. Riding a booming market, Swarthmore has generated a 17.8 percent gain last year and an average annual gain of 14 percent over the last five years.

Much of the credit goes to Mark Amstutz, chief investment officer at Swarthmore, an historically Quaker school situated on a garden-like campus west of Center City. His use of an asset class known as "private equity" - investing in private, or non-traded, companies - has helped fuel returns.

"My view on private equity is it is equity [stocks] on steroids," Amstutz told Bloomberg News, which published the latest endowment figures. "You don't want to own anything private unless you get a higher return."

So, what's in Swarthmore's portfolios?

According to a recent breakdown: "marketable alternatives," which in Wall Street lingo refers to alternative investments such as hedge funds ($243 million); private equity funds ($316 million); "real" assets, such as real estate and commodities ($146 million); fixed income ($38.25 million); and public equity, or common stocks ($164 million).

How would ordinary investors mimic Swarthmore's investment style? They can't, says Chuck Widger, founder of Brinker Capital, who has sat on Gettysburg College's endowment board.

One firm has tried to create an endowment-like fund based on a book titled Unconventional Success, by Yale University endowment manager David Swensen.

This exchange-traded fund, or ETF, aims for returns similar to the investment portfolios of Yale, a model made famous by Swensen, but using publicly traded companies and funds. Set up by ETF Portfolio Management in Thousand Oaks, Calif., this exchange-traded fund invests in public real estate investment trusts and U.S. and global stocks to try to mimic Yale's portfolio.

Launched in 2012, the Yale-model ETF in 2014 gained 9 percent, versus 13.5 percent for the S&P 500. In 2013 the ETF was up 10 percent versus 32 percent for the S&P.

"Swensen counsels against retail investors using the non-traditional asset classes because retail investors lack the resources and expertise to evaluate and manage them," Widger says.

Swarthmore's endowment also did well long term, with 10-year returns of 8.8 percent annually. That places it in the company of top-performing endowments at Yale, the University of Pennsylvania, Princeton, and Harvard.

Ten-year returns averaged 7.1 percent for colleges nationally, according to last year's data for 832 U.S. colleges and universities from the NACUBO-Commonfund Study of Endowments for the 2014 fiscal year (July 1, 2013-June 30, 2014).

Asset Allocation

Swarthmore's asset allocation - how it divides its endowment money - is the key, says Kenneth Redd, director of research at NACUBO in Washington.

"This year was a very good year in U.S. stocks, venture capital, and in private equity. If a school had outsized performance this year, it was due to those asset classes," Redd said.

Size helps, as billion-dollar endowments have access to money managers who do not accept smaller investors, Redd adds.

Schools such as Swarthmore with more than $1 billion in assets typically allocated 12 percent of assets to private equity, 5 percent to venture capital, and 13 percent to U.S. stocks. Swarthmore wouldn't detail its numbers. CIO Amstutz, who works on the Swarthmore campus, declined repeated requests for comment and did not respond to e-mailed questions.

The college's investment committee, made up of paid advisers and alumni, also plays a role.

Swarthmore paid outside managers to help direct its endowment, listed in IRS tax filings known as Form 990s. Amstutz earned $250,000 in total compensation, including salary and deferred bonuses, according to the latest filing.

Others who earned fees were Hamilton Lane of Bala Cynwyd, paid about $866,000, the highest-paid consultant; Cambridge Associates, a widely relied-upon endowment consulting firm based in Boston, which received $734,000; and Prospector Partners, an investment advisory and hedge fund management firm in Guilford, Conn., which received $282,000.

Prospector holds roughly 175 stock positions, according to publicly available filing data and StreetSight.net's database of holdings.

One alumnus-run fund was also paid fees by Swarthmore. Marshfield Associates earned $196,000 in investment management fees in the most recently disclosed fiscal year. Marshfield, based in Washington, is run by Christopher Niemczewski, a Swarthmore alum and trustee.

Marshfield invests in a more concentrated way, holding between 25 and 30 stocks at one time in its $1.3 billion fund. Holdings include Deere and Devon Energy, Union Pacific, Moody's, Visa, MasterCard, Fastenal, Expeditors International, John Deere, and Yum! Brands, according to an investor letter dated February 2015.

It is unclear what portion of assets Marshfield manages for Swarthmore. Niemczewski, a 1974 alumnus, is a member of the college's board of managers. He has chaired Swarthmore's investment committee since 2007 and is responsible for investing the endowment and finding external consultants and managers to invest and manage it.

The school has been a client of Marshfield Associates since 2002. Niemczewski would not comment for this article.

Haverford College paid investment consultant Cambridge Associates just over $277,000 in the last fiscal year's 990 filings. Its director of investments, Michael Casel, earned $264,000.

The University of Pennsylvania's chief investment officer, Kristin Gilbertson, earned $1.68 million.

215-854-2808 @erinarvedlund